Trust Services

An SNTC Trust is a necessary infrastructure to ensure your loved one receives the gifts under your will, insurance and/or CPF nomination.

Download the information brochure to find out more:

- Information Brochure (EN) (1.3MB)

- Information Brochure (CN) (1.8MB)

Caregiver setting up the SNTC Trust (Settlor) should be:

- 21 years and above

- Has mental capacity

- Not an undischarged bankrupt

Person with special needs (Beneficiary) should be:

- Singapore citizen or Permanent Resident

- Residing in Singapore

- A person with mental health condition which can include dementia OR Has a permanent disability based on any one of the following:

- Physical Disability: Requires assistance with at least one of the six Activities of Daily Living (ADLs) due to a physical impairment

- Moderate visual impairment or worse in the better eye

- Moderate hearing loss or worse in the better ear

- Intellectual disability

- Autism

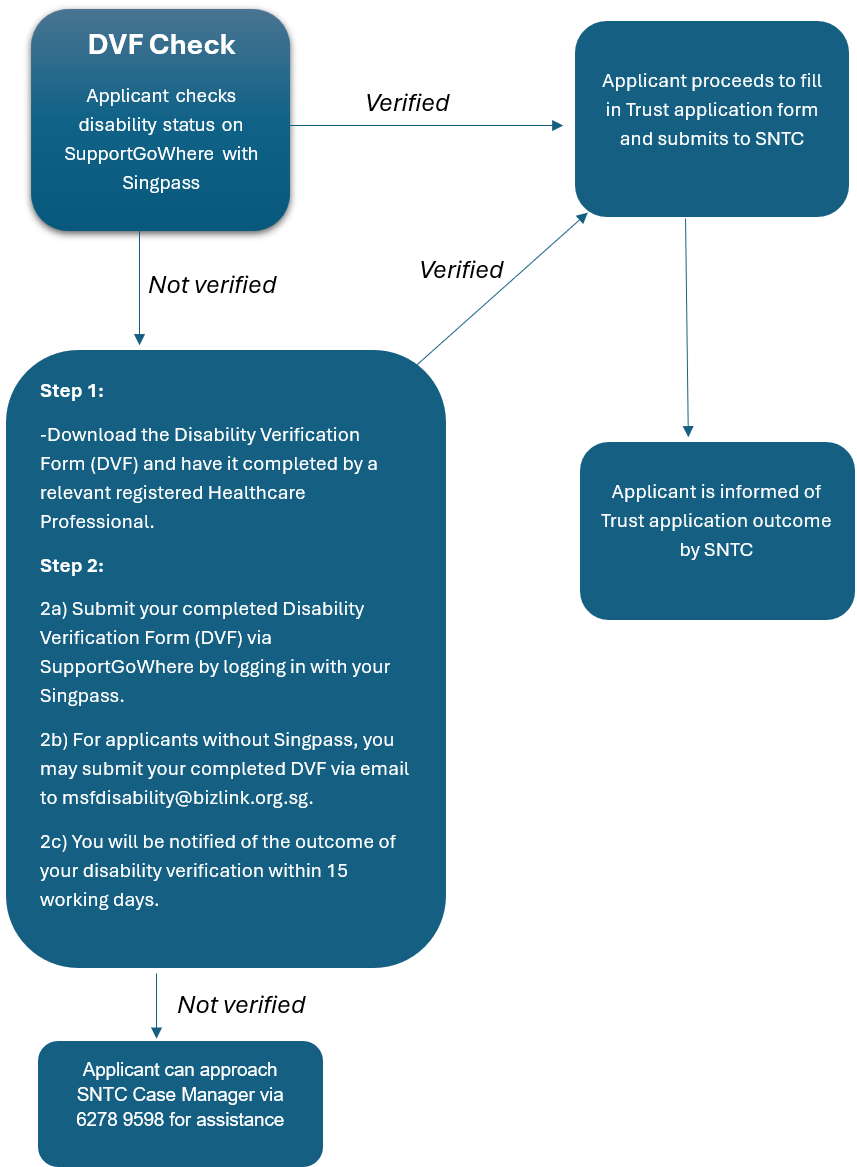

Proof of disability must be provided using the Disability Verification Form (DVF) completed by a relevant registered Healthcare Professional.

Q: What is Disability Verification Form?

A: The Disability Verification Form (DVF) is a standardised proof of disability required to verify an individual's disability status when applying for selected MSF disability schemes and services and other selected Government disability schemes.

Q: How to check if my disability status is verified?

A: To check if your disability status is already verified, you can log into SupportGoWhere via Singpass. If you do not have Singpass, please call Bizlink at 64366635 or email msfdisability@bizlink.org.sg

Q: Where do I download the Disability Verification Form (DVF)?

A: You can find out more about Disability Verification and download the DVF from the Enabling Guide.

Q: What about those with mental health conditions, dementia etc?

A: Persons with mental health conditions including dementia are not required to have a DVF. For the application of Special Needs Trust, they have to produce doctor memo / medical report as proof of disability.

Q: How do I know if I need to submit a DVF?

A: Our Case Manager will advise on the need to complete the DVF, where relevant.

Q: Will verification slow down my application?

A: Not usually. Verification is part of our standard process. If more information is needed, we’ll let you know quickly.

Disability Verification Form (DVF)

User Journey for Special Needs Trust

Together with you (the Caregiver), SNTC will go through a holistic needs assessment of your loved one (the Beneficiary) that is focused entirely on his/her well-being. There is no obligation to set up a trust at this phase.

SNTC’s social work-trained Case Managers will develop a customised Care Plan to project the amount of trust funds that you will need to set aside to provide for your Beneficiary’s long-term care needs when you are no longer able or not around to look after him/her.

To begin with step 1, please contact us for an appointment with a Case Manager.To set up an SNTC trust account for the Beneficiary, an initial deposit of $5,000 is required. Sponsorships are available for lower-income families who are eligible. SNTC’s Case Managers will invite eligible caregivers to apply for the appropriate sponsorship schemes* during the trust set-up.

Once the SNTC trust account has been set up, you can choose to top up the trust account anytime via cash savings, will, CPF and/or insurance nominations.

The Public Trustee’s Office holds and invests SNTC trust fund, and the principal value of the trust fund is guaranteed by the Singapore government.

SNTC’s Case Managers will review the Care Plan with you and update the Letter of Intent to capture his/her changing needs. SNTC will also record your wishes in a Letter of Intent on the disbursement of trust fund for your loved one.

*Sponsorship Schemes

- GOAL Sponsorship Scheme

- Sponsorship for Elderly Caregivers

Muis Support for Persons with Special Needs

The Majlis Ugama Islam Singapura (Muis) encourages caregivers to set up trust accounts with SNTC to safeguard the long-term needs of their loved ones. Muis will support each eligible Muslim with special needs $5,000 to cover the initial capital of an SNTC trust account, and up to another $5,000 to the account on a matching contribution basis. Please refer to the following brochure for more details.

Download BrochureApplications for the Muis sponsorship has to be made through SNTC.

Upon your demise or incapacity, the SNTC trust account will be activated for your Beneficiary, and SNTC will act accordingly to your wishes in disbursing the funds for the long-term care needs of the Beneficiary.

What happens upon activation?

- SNTC will conduct a home visit for an immediate needs assessment of the Beneficiary, to follow-up on the Care Plan and discuss his/her accommodation needs.

- SNTC works with relevant parties including executors of your Will, insurance companies, and CPF Board to oversee the transfer of assets into the SNTC Trust.

- Funds will be disbursed monthly or periodically in accordance with your wishes set out in the Letter of Intent.

- Reviews will be conducted with your appointed caregiver to review and update the Care Plan and verify the balance in the SNTC Trust against disbursements made during the year.

- SNTC’s Case Managers will make periodic home visits to check on his/her welfare when you are no longer around.

- SNTC will work with your appointed caregiver to receive help from available resources in the community to support your loved one should the monies in the SNTC trust account run low.

The SNTC trust account will be terminated when one of the following circumstances happen:

- Upon demise of your beneficiary – SNTC will distribute any balance of the trust fund to your appointed Residual Beneficiaries as named in the Trust Deed.

- When the trust funds are fully utilised or otherwise exhausted before the demise of your beneficiary.

- Your beneficiary no longer resides in Singapore. SNTC will transfer the balance of the fund to another trust account in the country where he/she resides.

Help Us To Reach Out and Serve

If you know someone who will benefit from SNTC Trust Services, please refer them to us using the referral form below.

DOWNLOAD FORM